Benefits of Completing Amended Form 940 Online

Completing your Amended Form 940 is a great option for accurate and convenient filing. Check out all the benefits of filling out amended Form 940 online using our software.

.png)

Internal Audit Check

Our internal audit check ensures that your Forms are validated through IRS business rules, Basic Form Validation, and IRS Schema Validation. Any errors identified will be listed.

Access To Form Copies

After completing and filing Form 940 Amendments, they can be easily accessed in your account, anytime

Lowest Price

Complete and download Form 940 Amendment for just $1.49, It is very cost-effective.

USPS Address Validation

All the addresses entered on your Forms will be validated through our USPS Address Validation to verify that you have entered the right addresses on your Form.

Quick & Easy Filing

The filing process is easy-to-follow. Simply enter the form information to complete it within minutes!

Download Copies

While there are no recipients for the Form 940 Amendment other than the IRS, you can have a copy mailed to your business for your records.

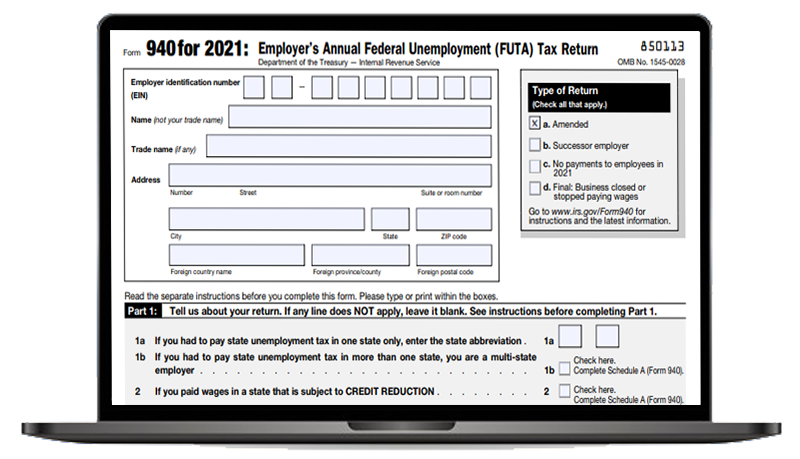

How to Amend Form 940?

Filling out your amended Form 940 is a simple, three-step process. Simply enter the amended information on the form, review it and resolve any errors, then print and mail it to the IRS.

Enter the Form 940

Amendment details

Provide the amended form information which needs to Amend

Review the

Summary Form

Review the summary form information that you provided and make any updates.

Download and Mail the

Completed Form to the IRS

Once completed you can print and mail it to the IRS

When is The Deadline to File Amended Form 940?

The Amended Form 940 is basically a correction form, so there is no set deadline with the IRS. However, there is a time limit in which you can file an amendment for a previously filed Form 940. All 940 amendments must be filed within three years of the original Form 940.

Frequently Asked Questions on Form 940 Amendment?

What is Amended Form 940?

The Form 940 amendment is a corrections form. If you filed a Form 940 with the IRS, and realized after filing that the return contained errors, you should file a 940 amendment to correct those errors.

How long does it take to complete the 940 Amendment?

Before beginning to file a 940 amendment, you will need to have your basic business information at your disposal. You will need to have access to the information filed on the original Form 940 as well as the correct, updated information. Once you have this information, you are able to fill out the amended 940 in minutes.

When is the deadline to file Form 940 Amendment?

The deadline for filing the Form 940 Amendment is not specific. However, you must file Form 940 Amendment within three years of the date on which the previous Form 940 was filed.

Ready to Fill out Form 940 Amendment

File Amended Form 940 in Minutes and Mail it to the IRS.

Get Started NowContact Us

Do you have additional questions about filling out the Form 940 Amendment?

Email your questions to support@taxbandits.com!

.png)